VAT tax price included release [related to the tax reform of the European Union and the United Kingdom]

Table of contents

Important!!! Must be done before August 5

I. Tax-inclusive display launch time and video interpretation

II. Changes in the front and backstage display including tax

1. The buyer's display includes tax

1.1 [Search Page]

1.2 [Channel Activity Page]

1.3 [Details Page]

1.4 [Shopping Cart]

1.5 [Ord Order]

1.6 [Order Details Page]

2. Seller's background

2.1 [Product Release]

2.2 [Order Details]

2.3 [Business Staff]

2.4 [Other Data Products]

III. Core concerns and impact areas

1. Marketing

1.1 [Shold Marketing Tools]

1.2 [Sing-price marketing tool]

1.3 [Discount Marketing Tools]

1.4 [Special attention to 828 registration]

2. Transaction

2.1 [Commodity Front Desk] Display

2.2 [Merchant Backstage] Order Details Page

2.3 [Price Adjustment] Scene

2.4 [Inspection] Scene

3. Settlement of funds

4. Refund

IV. Merchants must know what they must do

V. Frequently Asked Questions

1. [Tax price included] Front desk price display of goods

2. [Tax price included] marketing

3. [Tax price included] transaction

4. [Tax price included] refund

5. [Tax price included] Logistics

The text

Important!!! Must be done before August 5

From August 5, the countries of VAT tax reform will be launched one after another, including tax prices. Please be sure to complete the following matters before August 5:

1. The store coupons, full store discounts and full free shipping activities that end the activity after August 5 will end early. For the VAT tax reform country's tax rate, the function of setting up the preferential threshold by country is adjusted by country;

2. Since the matching package does not support sub-country for the time being, please evaluate the proportion of goods sold in the European Union and the United Kingdom by yourself, adjust or close the matching package activities after estimating taxes and fees in advance;

3. The national setting function of the store discount code is expected to be launched on August 15. Please evaluate the proportion of goods sold in the European Union and the United Kingdom according to the store discount code activity that ends later than August 5, close the activity and adjust the discount threshold after estimating taxes and fees in advance;

[Setting steps for national discounts]

Please read the function manual carefully before setting up: "Shop Country Discount Manual"

Step1: Set up country groups

In order to facilitate your limited country management, the function of national marketing grouping has been added this time. Click here to set up national grouping.

Step2: Set up country marketing campaigns

In the store coupon and full discount activity settings page, you can select the country according to the set national marketing group, or you can use the system country group:

VAT tax reform country, click here to view

VAT tax rate confirmation, click here to view

Country coupon tutorial, click here to view

Shop activity entrance, click here to enter.

I. Tax-inclusive display launch time and video interpretation

1. Important time nodes

1. The national marketing capacity will be launched on July 28, supporting the allocation of marketing discount thresholds by country;

2. The EU tax-inclusive price will be opened on August 5, and the EU is scheduled to open in full capacity on August 10 (see the on-site letter announcement for details)

3. At present, it has been launched in Luxembourg, Malta, Ireland, Sweden and Poland, and has been launched on the consumer side display including tax in these five countries.

2. Video interpretation of tax price included

Live broadcast time: 2021-07-14 14:00 - 2021-07-14 15:00

Live playback, click here to view

Live content:

1. Display changes before and after the release of tax prices

2. Merchants need to pay attention and precautions

3. Frequently asked questions and their analysis

II. Changes in the front and backstage display including tax

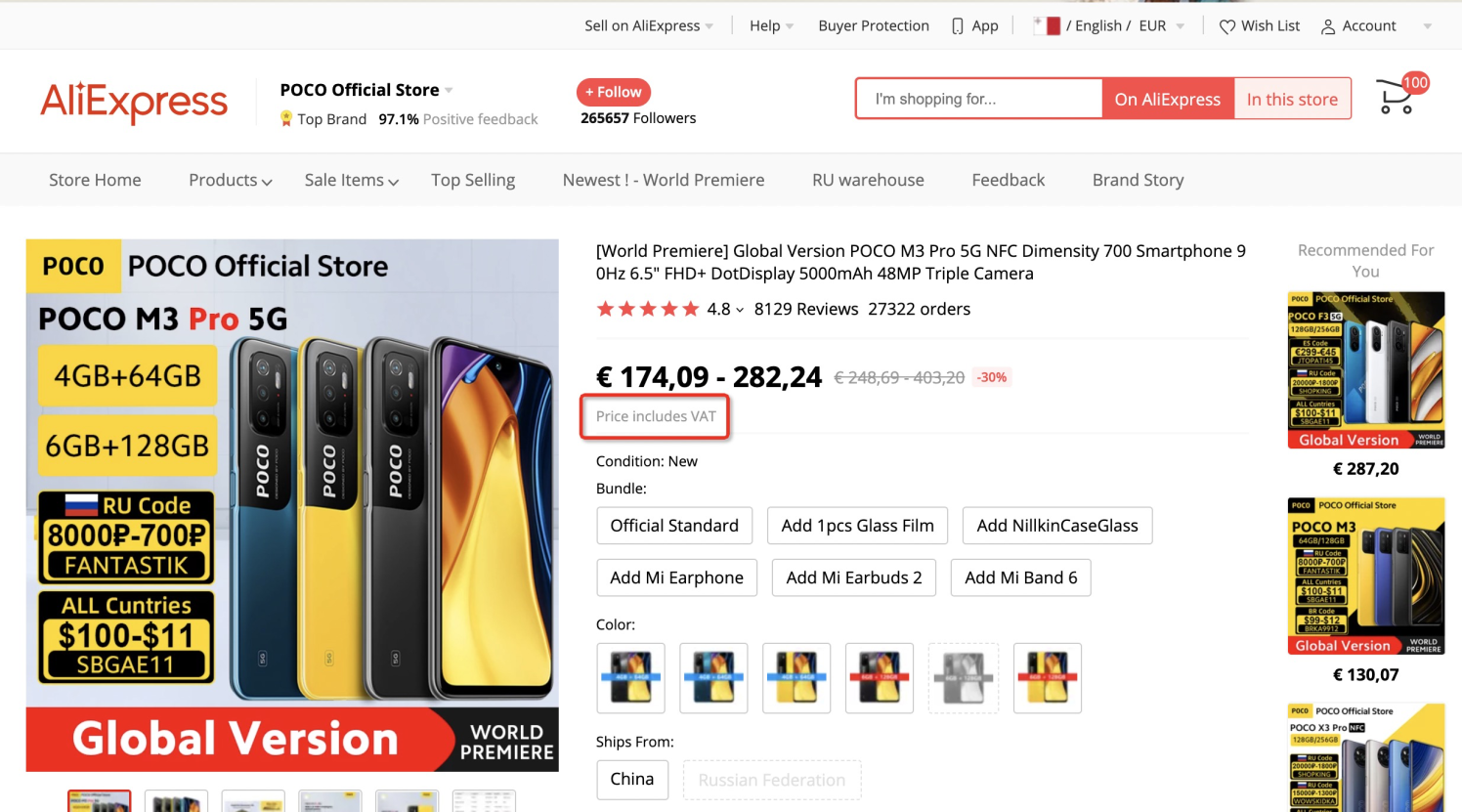

1. The buyer displays tax included (examples only, subject to the online page)

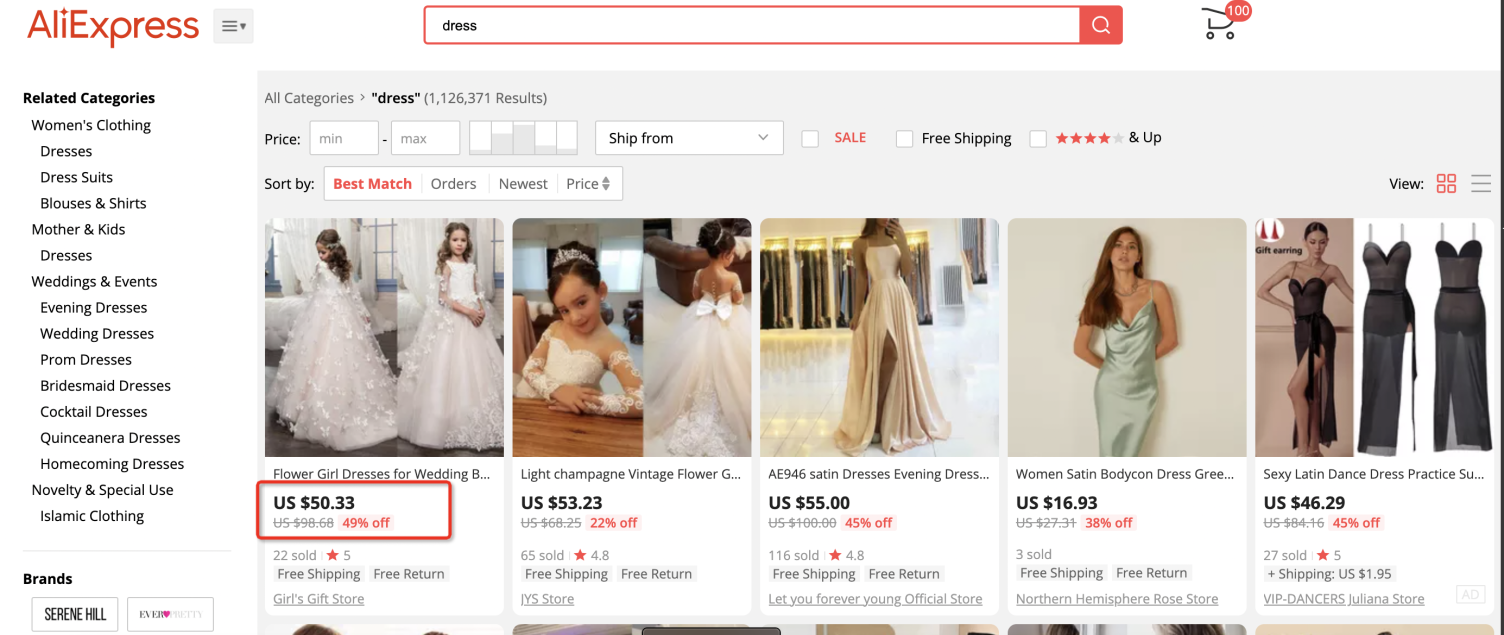

1.1 [Search Page]

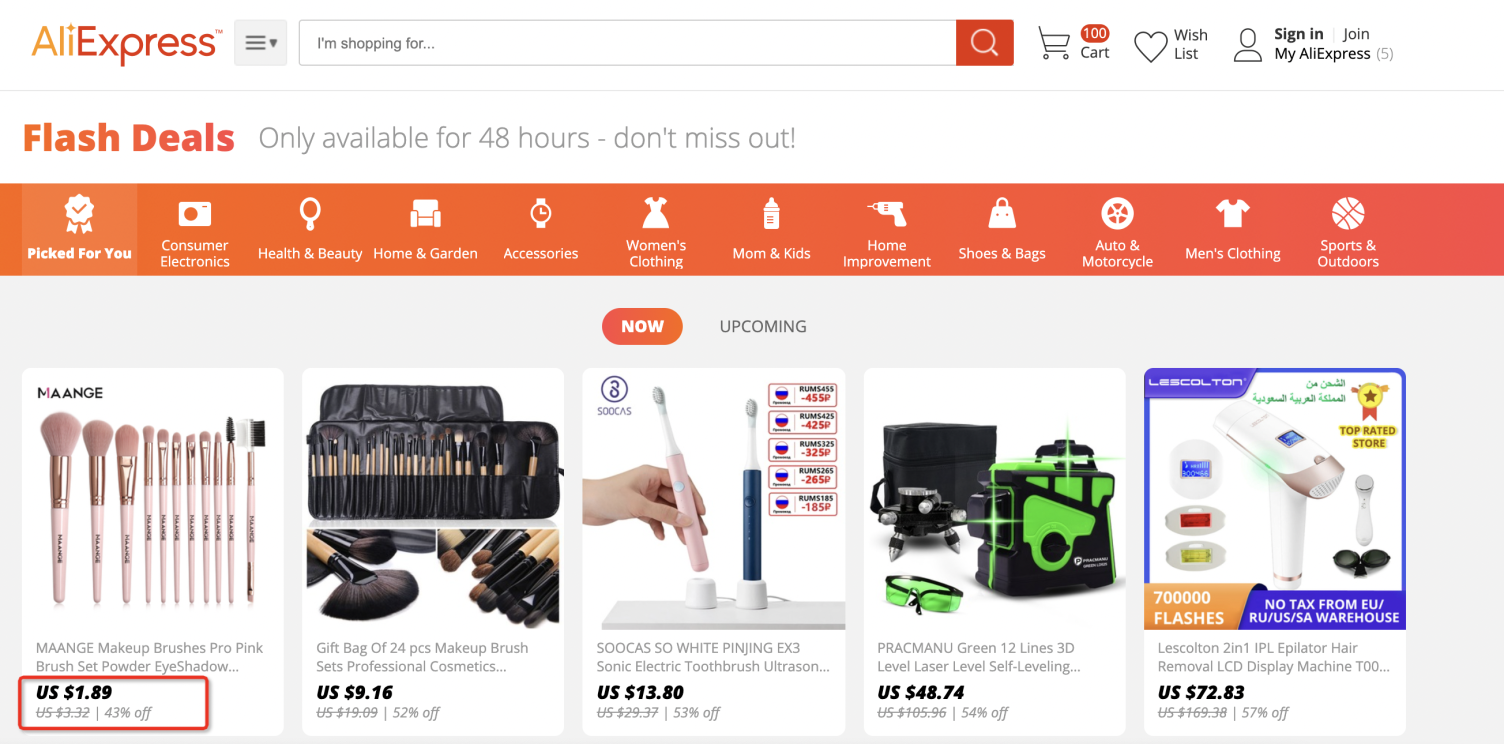

1.2 [Channel Activity Page]

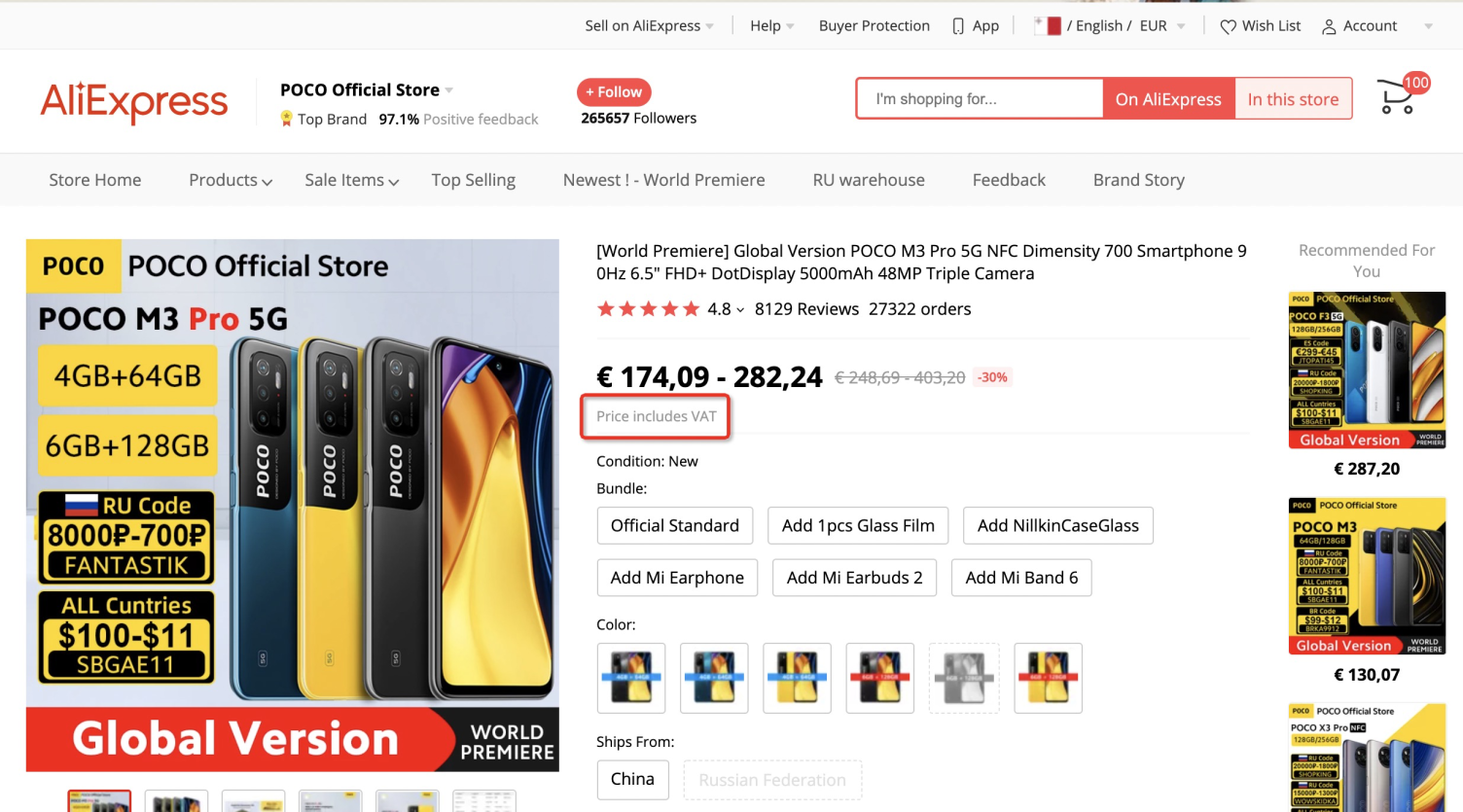

1.3 [Details Page]

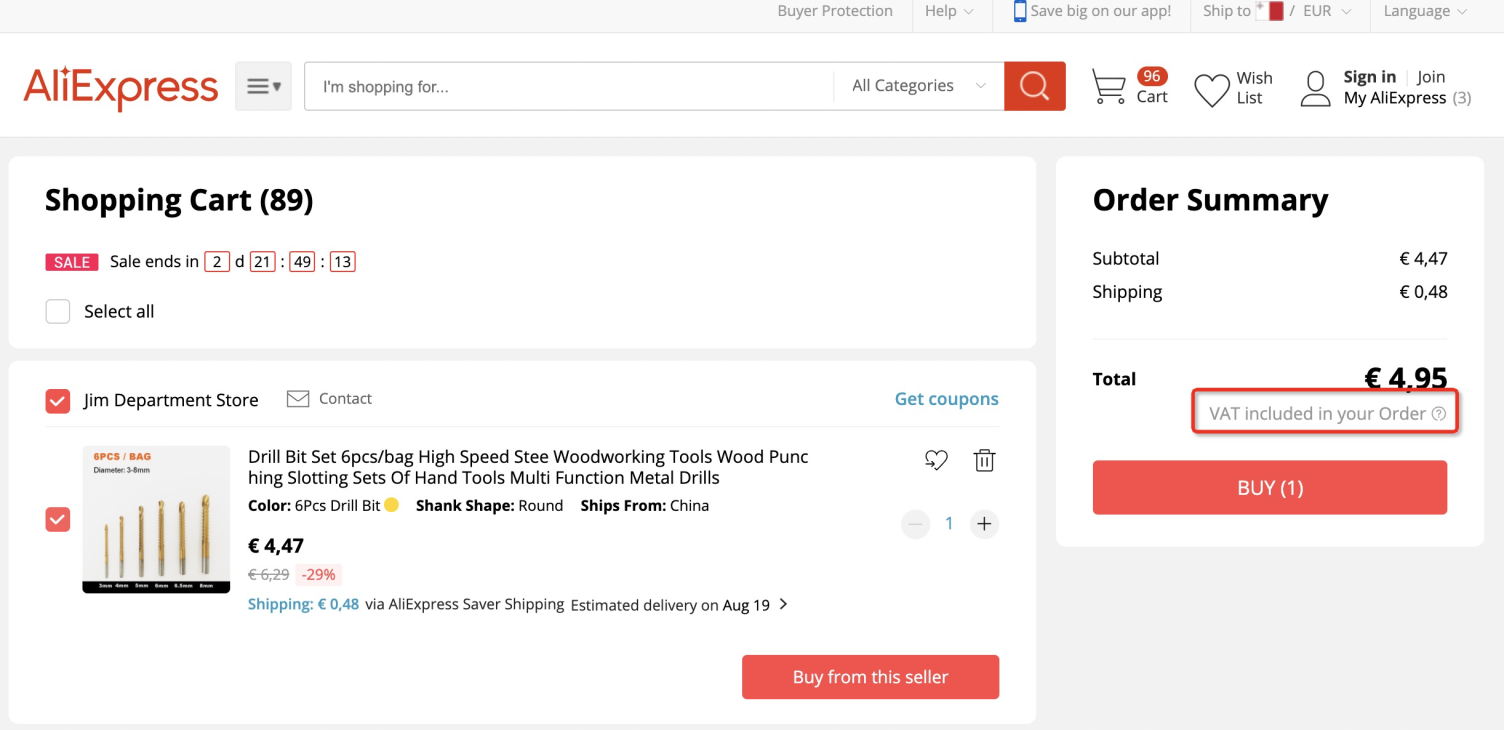

1.4 [Shopping Cart]

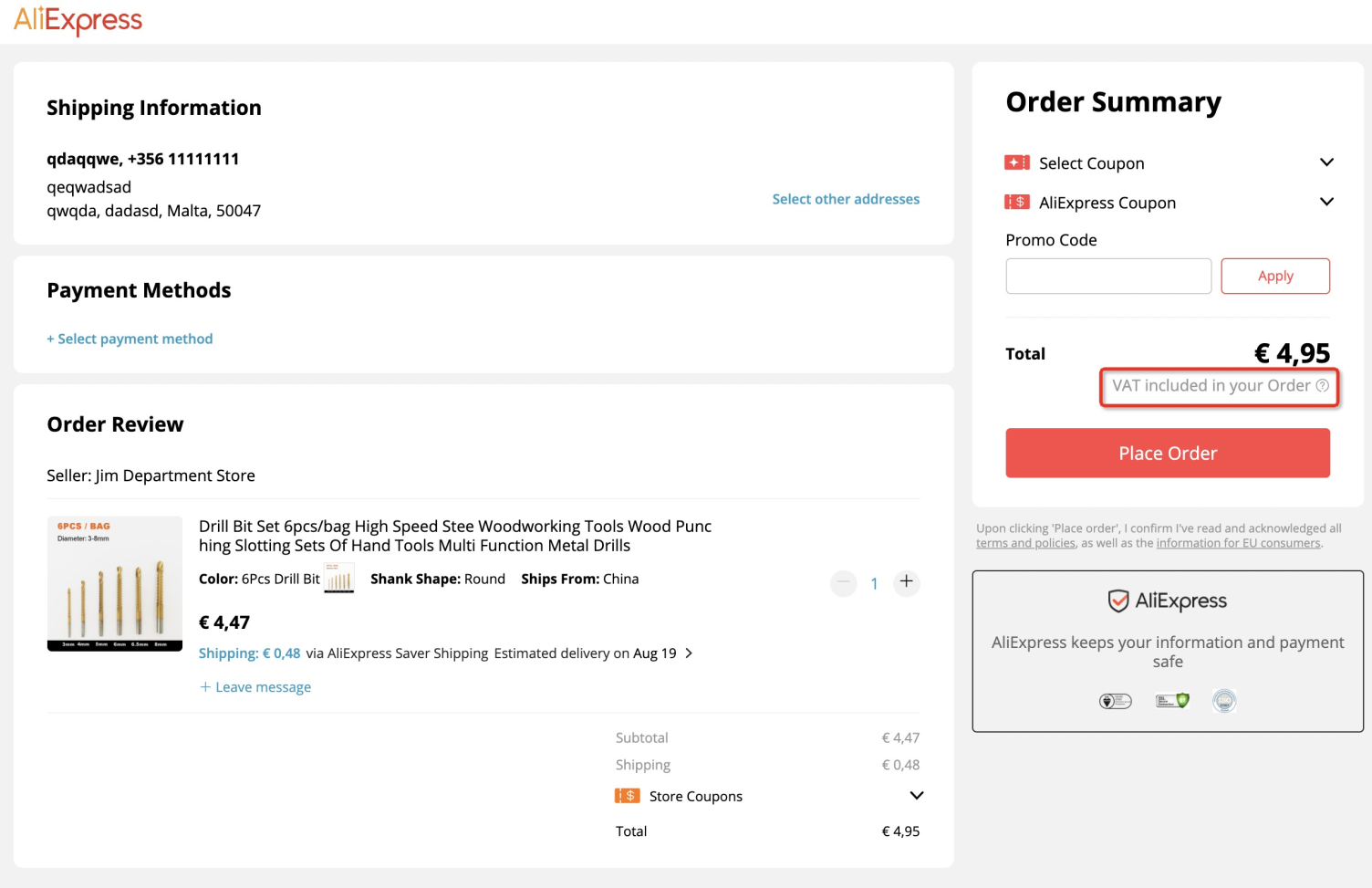

1.5 [Ord Order]

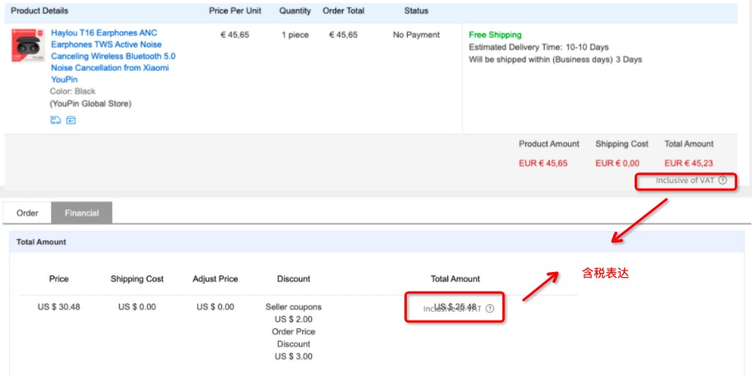

1.6 [Order Details Page]

2. Seller's background (examples only, subject to the online page)

2.1 [Product Release]

2.2 [Order Details]

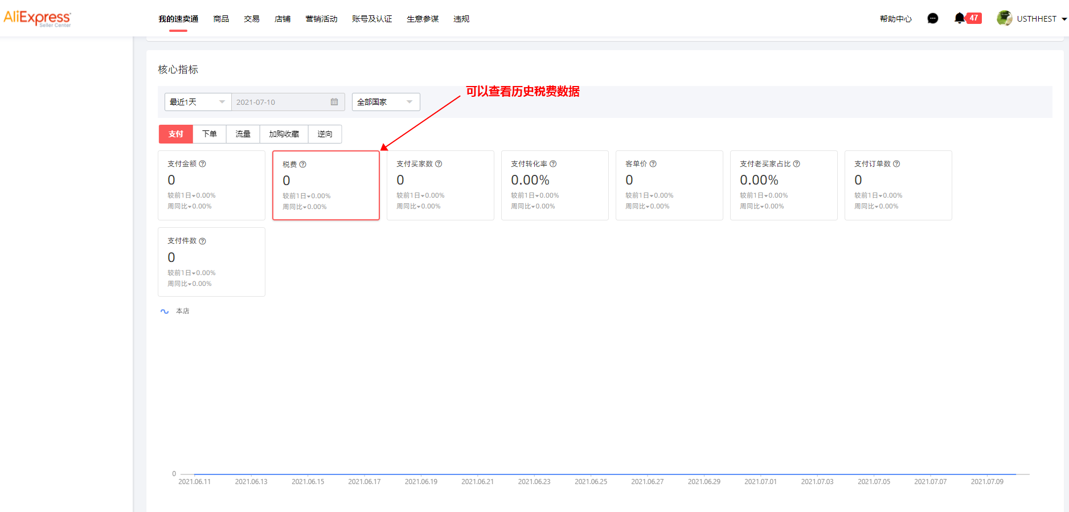

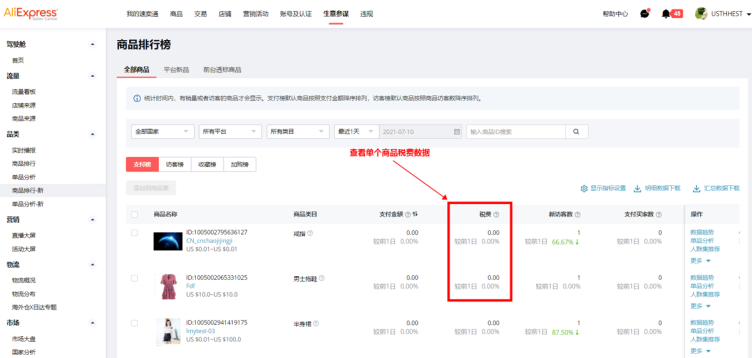

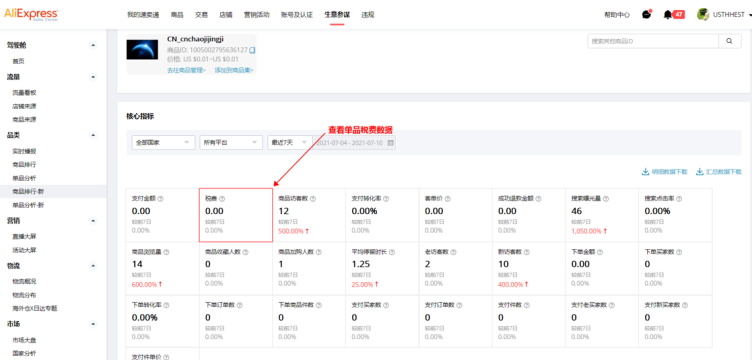

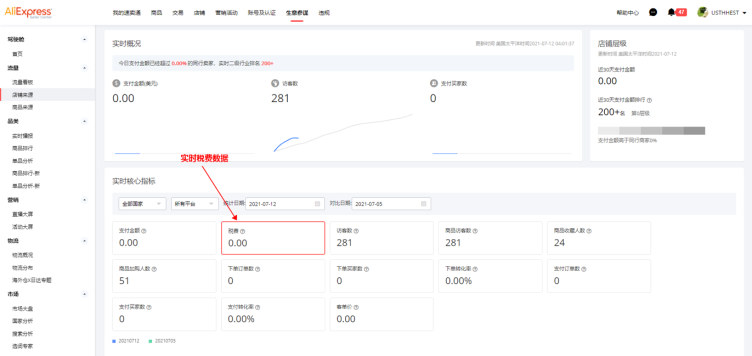

2.3 [Business Staff] Data calculation and definition update of the new version of real-time overview, new version of transaction analysis, commodity ranking and individual product analysis.

2.4 [Other Data Products] Affiliate marketing, through trains, data banking, etc. can directly pay attention to the description of page data fields.

III. Core concerns and impact areas

1. Marketing

1.1 [Shold Marketing Tools]

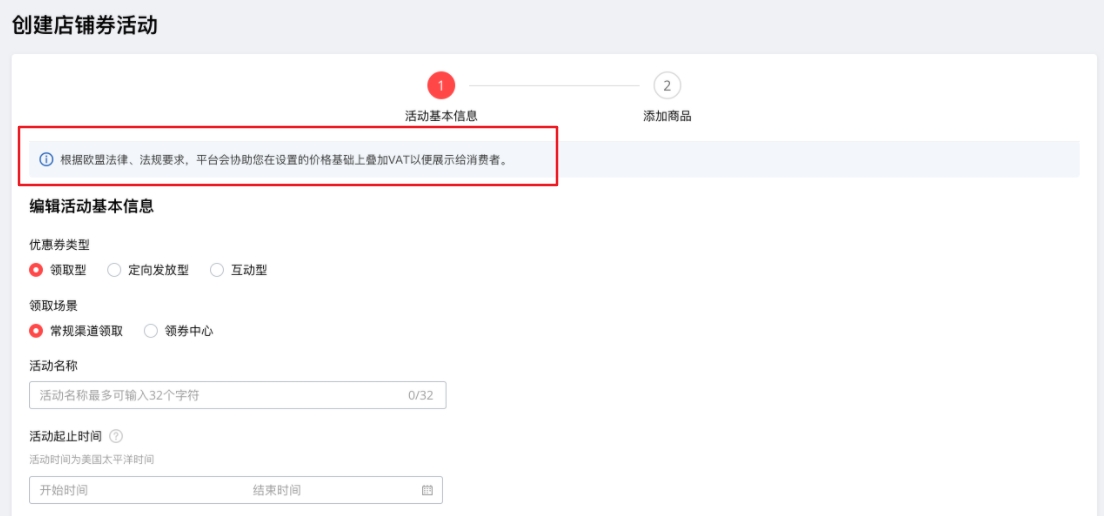

1) Merchants can see copywriting prompts on the setting interface (for reference only, please refer to the actual page prompts after the above line): According to the requirements of EU laws and regulations, the platform will assist you to superimpose VAT on the set price for display to consumers. The threshold for the use of coupons will take effect on the basis of tax included.

2) Case analysis: 1 The threshold activity including tax price may be met in advance, please pay attention to it! 2 The coupons that have been received are still valid and can be used.

Various preferential deduction orders: single product discount > cross-store full discount > oil plan (i.e. cross-store full free shipping) > store full free shipping > store full discount > store coupon > store discount code.

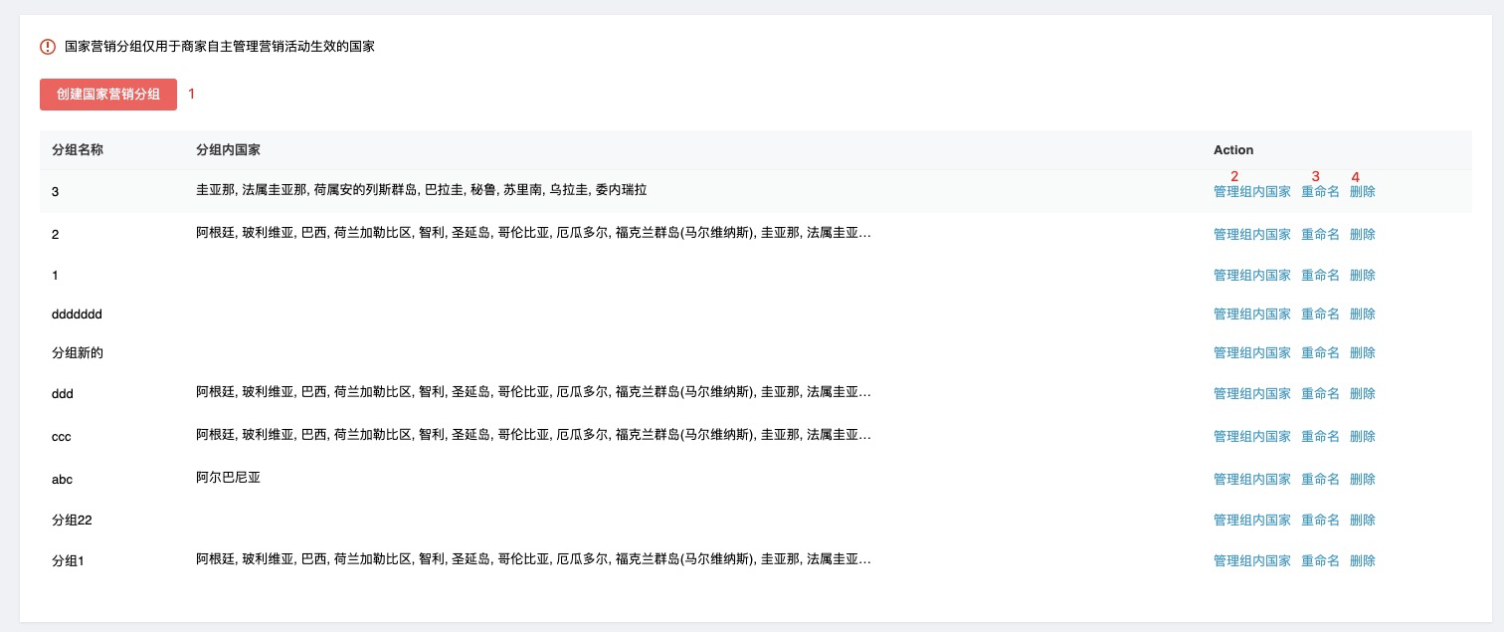

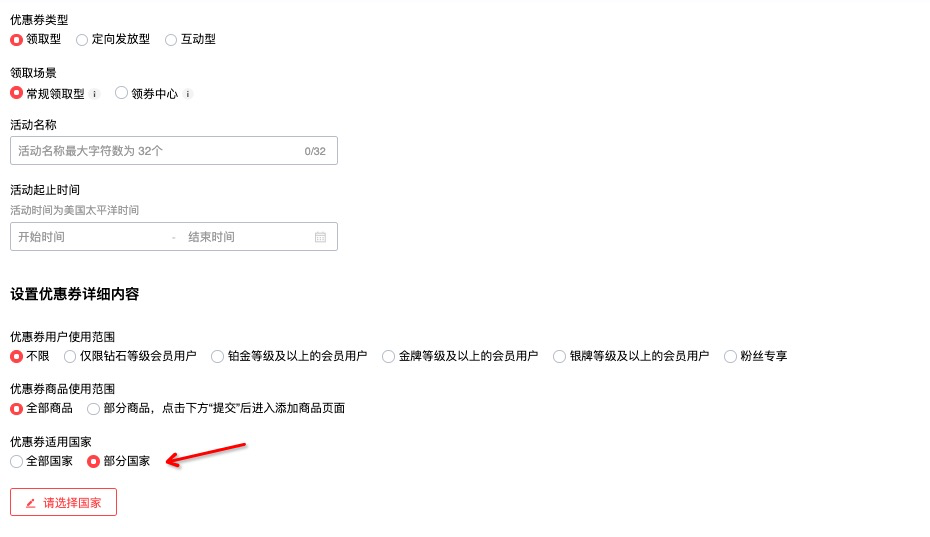

3) National marketing tools: launched on July 28 (store coupon, full free shipping, full discount, discount code); the setting steps are as follows (for reference only, please refer to the actual page prompts after the above line):

1 Preset the national group first: Log in to the merchant background and enter the "Marketing Campaign-Shop Activity", and there will be a national group entrance at the bottom of the page.

2 Select "Restricted Country" and filter the countries where the activity can take effect:

Click to check the full version of the "Shop Coupon Country Function User Manual". The manual of full discount and store discount code will be completed synchronously before the function is launched.

1.2 [Sing-price marketing tool]

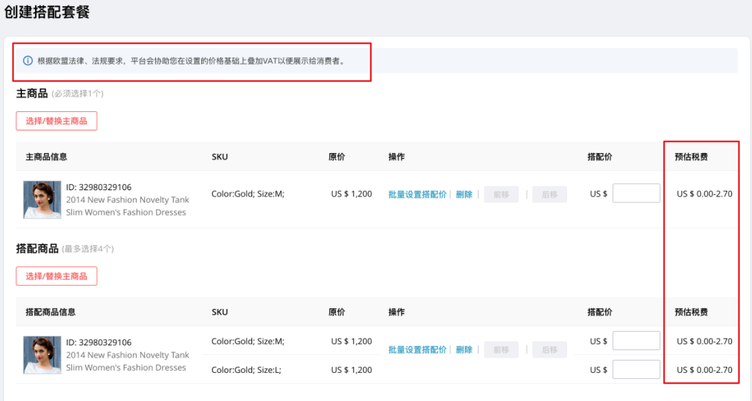

1) Merchants can see copywriting prompts on the setting interface (for reference only, please refer to the actual page prompts after the above line): According to the requirements of EU laws and regulations, the platform will assist you to superimpose VAT on the set price for display to consumers. One price is a price including tax, and the actual amount received may be less than the amount of one price.

2) After entering a price activity, the tax trial calculation will be provided on the page: estimated tax xx, for reference only.

3) Case analysis: copywriting reminders and tax trial calculation on the settings page of matching activities, gold coin channel activities, trial channel activities, etc. Merchants need to refer to the proportion of goods sold in the United Kingdom and EU countries, and modify the matching price after estimating taxes and fees in advance!

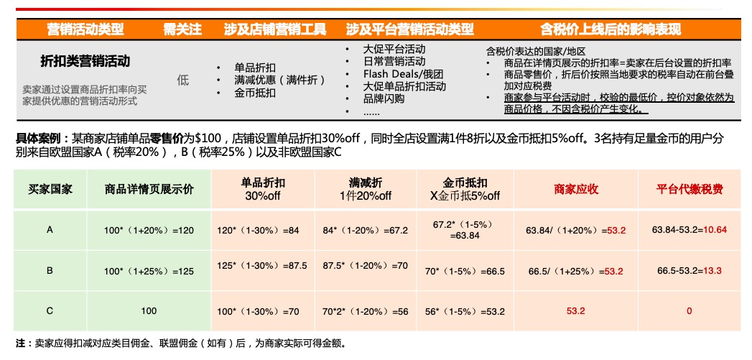

1.3 [Discount Marketing Tools]

1) Merchants can see copywriting prompts on the setting interface (for reference only, please refer to the actual page prompts after the above line): According to the requirements of EU laws and regulations, the platform will assist you to superimpose VAT on the set price for display to consumers.

2) Case analysis: 1 Whether tax included has no impact on the discount; 2 The lowest price and the large-scale price control verification are still commodity prices, and tax included has no impact.

1.4 [Special attention to 828 registration]

1) Registration Impact

The platform promotion and the promotion of individual product discount activities are discount marketing activities. Whether the tax included has no impact on the strength of discounts;

The cross-store full reduction activity required by the registration platform promotion, whether tax is included or not, consumers can meet the threshold. According to the threshold of $30-3 currently required by the platform, merchants who sign up for cross-store full reduction activities (or goods that are automatically added to cross-store full reduction due to registration platform activities) need to be calculated and reported by themselves. On the basis of the name discount rate, can an additional 10% off (i.e. 10% discount) bear the preferential force?

The object of the lowest price verification promotion and price control verification is still commodity prices, and there will be no change due to the tax price included.

2) Considerations

Since the price of goods displayed will "increase" after the tax price is launched. If merchants want to reduce the price and give profits to consumers, due to the registration promotion activities or other daily platform activities, the price of goods will be prohibited from editing the retail price, the price can be reduced in the following ways:

Scenario 1: I have signed up for 828 promotion platform activities or other daily platform activities, but have not been reviewed. How to deal with it?

Solution: During the investment period, adjust the retail price of goods to re-register, or adjust the registration discount rate.

Scenario 2: I have signed up for 828 promotion platform activities or other daily platform activities, but have been approved. How to deal with it?

Solution: Before the warm-up period, adjust the registration discount rate through "price reduction".

Scenario 3: Goods that have signed up for 828 promotion activities have signed up for other daily activities at the same time. Because the price control of the promotion cannot adjust the daily discount rate, how to deal with it?

Example: The daily discount rate of goods is 30% off, and the discount rate of big promotion is 31% off. Because the daily discount rate of the price control rules needs to be lower than the promotion discount rate, it cannot be adjusted.

Solution: First adjust the promotion discount rate to 35% off, and then adjust the daily discount rate to 34% off.

Scenario 4: The store's promotion of individual product discounts cannot be reduced after the investment. How to deal with it?

Solution: Please calculate the commodity price in advance to ensure that the promotion price is competitive.

2. Transaction

2.1 [Commodity Front Desk] Display

Field explanation and calculation formula

1 Discounted price including tax: retail price of goods* (1+tax rate)* (1-discount rate)=USD200*(1+0.2)*(1-0.5)=USD120

2 Tax-inclusive line price: retail price of goods* (1+tax rate) = USD200* (1+0.2) = USD240

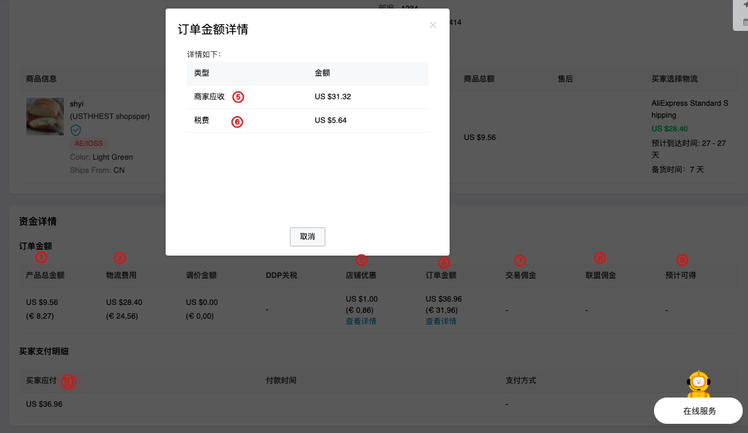

2.2 [Merchant Backstage] Order Details Page

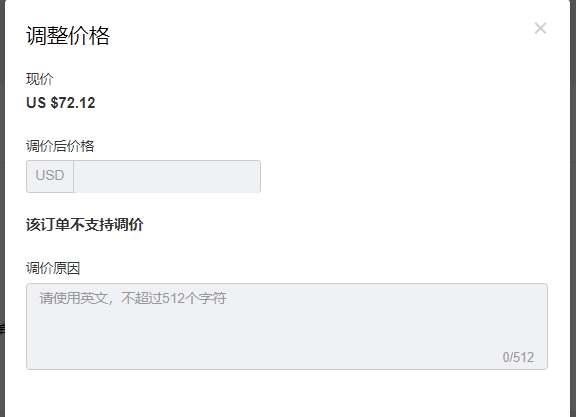

2.3 [Price Adjustment] Scene

The adjusted amount includes tax, and the trial tax is also calculated.

2.4 [Inspection] Scene

Increase Order Tax Trial Calculation Amount

Increase payment methods

Increase the actual arrival amount and trial tax

3. Settlement of funds

At present, the merchant workbench menu: fund account - fund settlement record - maintain the original tax-inclusive logic

The order amount in the fund settlement statement does not include "taxes collected and fees collected by the platform according to the regulations of the buyer's location", and taxes and fees are not included in the base amount of platform transactions and alliance commission, and the platform does not draw taxes and fees from merchants.

4. Refund

The refund amount includes tax, and merchant refund, tax refund and commission refund are calculated proportionally.

Case: Order A, the consumer payment amount is USD 100, of which merchants can get USD 80, taxes and fees are USD 15, and the platform commission is USD 5.

1 When consumers apply for a full refund, the refund is USD 100, the merchant refunds USD 80, and the tax USD15 and the platform commission USD5 are refunded together;

2 When consumers apply for a partial refund, the refund is USD 80, the merchant refunds USD 64, and the tax USD12 and the platform commission USD4 are refunded together.

IV. Merchants must know what they must do

1. Preferential threshold: coupon + full discount + full free shipping + preferential code discount threshold adjustment;

2. Time adjustment: the original activity time adjustment time ends on August 5, and the effective time of the new activity starts on August 8.5;

3. Countries involved: EU + UK

4. Marketing settings: 1) Set the national preference threshold for ship to the European Union + the United Kingdom; 2) The preferential threshold for raising the threshold of reference tax rate value;

5. Matching package: self-referenced goods as a proportion of sales in the European Union + the United Kingdom, adjust or close the matching package activity after estimating taxes and fees in advance.

6. Pricing points: platforms below 150 euros have collected and paid on their behalf, and there is no need to put taxes in when commodity pricing; platforms above 150 euros do not collect and pay on behalf of others (except overseas warehouses);

V. Frequently Asked Questions

1. [Tax price included] Front desk price display of goods

Q: How to display the front desk price after the tax price is launched?

Answer: The corresponding tax rate will be superimposed according to the retail price set by the merchant. If the merchant sets a regional price, the user will superimpose the corresponding tax rate on the basis of the regional price. The specific calculation formula is: commodity retail price/regional price * (1+ tax rate)

Q: What is a tax-inclusive quotation?

Answer: At present, the tax-inclusive quotation is planned and is expected to be launched at the end of August. In fact, please pay attention to the platform notice during the online time.

Q: Does the search page not display tax-inclusive labels after the tax-inclusive price is launched?

Answer: Yes, it is only displayed on the product details page, shopping cart and order page;

Q: How is VAT displayed in the UK and the EU?

Answer: The tax-inclusive logo will be displayed on the product details page, shopping cart and order page; for details, please refer to the demo above.

Q: If there are both overseas warehouse delivery places and Chinese delivery places, will products above 150 euros/135 pounds be displayed with tax included?

Answer: Yes, all show tax included.

Q: For goods less than 150 euros/£135, do small B buyers see the same prices as small C buyers?

Answer: Inconsistency, what small B buyers see is the price without tax.

Q: Why does the tax-inclusive display inconsistent with the settings of the publishing page?

Answer: The tax-inclusive price on the publishing page is calculated based on the retail price and the VAT tax rate of the ship to country you fill in on the posting page, which is convenient for you to understand the tax situation in the EU countries, but the tax rate and currency exchange rate classified according to the type of goods and the goods may vary, so the tax price included is the most The final display results may not match the price set by the publishing page.

Q: How should the merchant fill it out?

Answer: On the product release page, after filling in the retail price, the platform will automatically calculate the tax price. Note: The retail price and wholesale price of goods need to be set by themselves in combination with store coupons, full discounts and other preferential thresholds.

2. [Tax price included] marketing

Q: How does the tax-inclusive price affect different activities/offer?

A: Different activities have different impacts, please review them according to the actual situation:

Type of activity | Front-end performance | Risk level | Specific impact | Action Required |

Threshold store marketing activities The store is full of free shipping. Shops are full and down. Store coupons Store discount code | The foreground is a form of marketing campaign that can trigger the offer after meeting a condition. | High | The threshold for store full reduction activities may be met in advance in the corresponding area, creating the original expectation that the store will not be able to achieve the unit price of customers through the threshold activities, and there is also a risk of excessive discount. | Adjust or close the original activity and set up a new activity through the country function. |

One-price marketing campaign Shop matching package Gold Coin Channel Trial Channel Bargain | Marketing campaign forms that provide preferential treatment to buyers through specific channel pages | Medium | Commodity activity price = the price filled in by the seller when setting/registration, which includes the corresponding regional tax, that is, the price set/registered by the merchant is including tax. | Adjust or close the matching package price. |

Discount marketing activities Discounts on store items Full discount for the store Store gold coin deduction Promotional discounts on individual products Promotion platform activities Daily marketing activities Flash Deals/Asia League ... | Sellers provide preferential marketing activities to buyers by setting commodity discount rates. | Low | The discounted price automatically superimposes the corresponding taxes and fees at the front desk according to the local tax rate, including tax, which has no impact on the discount; For the lowest price verified, the target of price control is still the commodity price, and there will be no change due to the tax price included. | None. |

Q: How to reduce the price after signing up for the activity because the tax-inclusive price is too high?

A: You can reduce the price in the following ways according to your actual scenario:

Scene | Solution |

I have signed up for 828 platform promotion activities or other daily platform activities, but have not been reviewed. | During the investment promotion period, adjust the registration discount rate, or adjust the retail price of goods to re-register. |

I have signed up for 828 platform promotion activities or other daily platform activities, but have been approved. | Adjust the registration discount rate through "price reduction" before the warm-up period. |

Goods that have signed up for 828 promotional activities have signed up for other daily activities at the same time. Due to the price control of the promotion, the daily discount rate cannot be adjusted. Example: The daily discount rate of goods is 30% off, and the discount rate of big promotion is 31% off. Because the daily discount rate of the price control rules needs to be lower than the promotion discount rate, it cannot be adjusted. | Adjust the discount rate of the promotion to 35% off first, and then adjust the daily discount rate to 34% off. |

The store's promotion of individual product discounts cannot be reduced after the investment is completed. | Commodity prices need to be measured in advance to ensure that the price promotion is competitive. |

Q: What is the impact of tax-inclusive prices on the 828 promotion registration?

Answer: The online price including tax has little impact on the registration of 828 promotion. The specific reasons are as follows:

The platform promotion and the promotion of individual product discount activities are discount marketing activities. Whether the tax included has no impact on the strength of discounts;

The cross-store full reduction activity required by the registration platform promotion, whether tax is included or not, consumers can meet the threshold. According to the threshold of $30-3 currently required by the platform, merchants who sign up for cross-store full reduction activities (or goods that are automatically added to cross-store full reduction due to registration platform activities) need to be calculated and reported by themselves. On the basis of the name discount rate, can an additional 10% off (i.e. 10% discount) bear the preferential force?

The object of the lowest price verification promotion and price control verification is still commodity prices, and there will be no change due to the tax price included.

Q: Participated in the cross-store full discount. How to calculate the discount after tax?

Answer: Calculated according to the proportion of the tax price of the goods.

Tips: For the cross-store full discount activity required by the registration platform promotion, whether tax is included or not, consumers can collect orders to meet the threshold. According to the threshold of $30-3 currently required by the platform, merchants who register for cross-store full discount activities (or goods that are automatically added to the cross-store full reduction due to registration platform activities) need to On the basis of the registration discount rate, it is enough to calculate whether an additional 10% off (i.e. 10% off) can afford the discount.

Q: Where is the coupon collection center displayed?

Answer: There is no entrance on the PC side of the coupon center, and the app terminal is on: Account-Coupon Center.

3. [Tax price included] transaction

Q: How to calculate the tax for an order of $0.01?

Answer: No matter what the commodity price is, the tax calculation and display will be increased, but if the tax is less than 0.01, then 0.01 will be the tax price included.

Q: Are goods with tax inconsistent with the previous payment?

A: There are generally the following common situations:

1. The goods on the search and product details page have been taxed, but some marketing tools only serve on transactions (such as full discounts, coupons/code, etc.). If the goods are less than 150 euros/135 pounds after placing an order to offset the discount, they need to be recalculated. Consumers will feel overpayment when placing an order;

2. In the search, product details page, etc., it is the processing of the single product dimension. The order is the main order dimension processing. If the item does not exceed 150 euros/135 pounds, it will not be taxable when the multiple products exceed it is exempted. Consumers will feel that the payment is underpaid when placing an order.

3. Small B users see non-tax-inclusive prices when browsing goods. When placing an order, small B's identity is invalid, and there will be tax-inclusive prices; the price will change;

4. The country settings and receiving addresses of the order page of users browsing goods are different. If the tax rates of the two addresses are different, the price will change;

Q: Why doesn't the buyer's payable match the order amount?

Answer: This situation is generally due to the fact that buyers use platform discounts or payment channels to provide discounts. For you, you only need to pay attention to the expected available part, which is the amount you will actually receive.

Q: How is the amount calculated for each field on the order details page? ≤150 euros/£135)

A: The calculation formulas for each field on the order details page are different. For you, you only need to pay attention to the expected available part, which is the amount you will actually receive.

For example: Commodity A, set the retail price of goods to USD 200, the tax rate of goods to EU X is 20%, set a 50% off for individual product discount, a full discount of 120-10, a coupon of 110-10, and a discount code of 100-10, according to the length, width, height and route set. The calculated freight rate is USD10, the commission rate for goods is 8%, and the commission rate for logistics fees is 5%, and a 10% alliance commission is set.

Field explanation and calculation formula:

1 Total product amount: commodity amount* (1+tax rate)* (1-discount rate) = USD200* (1+0.2)* (1-0.5)=USD120

2 Logistics costs: freight* (1+tax rate) = USD10* (1+0.2) = USD12.00

3 Expected value-added tax [platform tax]: (total product amount - store discount) * tax rate / (1+ tax rate) + logistics cost * tax rate / (1 + tax rate) = (120-30) * 0.2/1.2 + 12*0.2/1.2=USD17 "platform taxed tax" means that the platform has been related Regulations charge VAT from buyers;

4 Store discount: full discount - USD10, coupon - USD10, discount code-USD10, total USD30 (according to the order of discount deduction, meet the sum of the store discount threshold, various discount deduction order: single product discount > cross-store full discount > oil plan (i.e. cross-store full) Free shipping) > full free shipping > full discount > store coupon > store discount code)

5 Order amount: product amount + logistics cost - store discount - expected VAT = USD 120 + 12-30-17 = USD 85

Tax-excluding logistics fee portion of order amount: logistics fee / (1+ tax rate) = USD10

Tax-exclusive goods part of the order amount: order amount - tax-excluding logistics fee part of order amount = USD85-10=USD75

6 Transaction commission: tax-exclusive commodity part of the order amount * commodity commission rate + tax-exclusive logistics fee part of order amount * logistics commission rate = USD75*8% + 10*5% = USD6.5

7 Affiliate Commission: Tax-free Commodity Part of Order Amount * Alliance Commission Rate = USD75*10% = USD7.5

8 Expected availability: Order Amount - Transaction Commission - Alliance Commission = USD85 - 6.5 - 7.5 = USD 71

9 Buyers pay: product amount - store discount + logistics fee = USD 120-30 + 12 = USD 102

If the order uses the platform/payment channel discount, the platform/payment channel discount amount needs to be subtracted, and the merchant cannot know the specific discount amount, so when the merchant finds that the buyer's payable is not in line with the order amount, it is generally due to the use of platform/payment channel discount.

Q: How is the amount calculated for each field on the order details page? ≥150 euros/135 pounds)

Answer: After the tax-inclusive price is launched, the product amount in the fund details has been included in tax, but the actual platform of more than 150 euros/135 pounds will not pay withholding taxes and fees. The actual buyer of the "tax-free amount" shown does not pay taxes. Merchants need to calculate the commodity amount-tax-free amount when reconciling.

For example: Commodity A, set the retail price of goods to USD 300, the tax rate of goods to EU X is 20%, 50% off for individual product discount, full discount of 120-10, coupon of 110-10, discount code of 100-10, according to the length, width, height and route set. The calculated freight rate is USD10, the commission rate for goods is 8%, and the commission rate for logistics fees is 5%, and a 10% alliance commission is set.

The field explanation and calculation formula are as follows:

1 Total product amount: commodity amount* (1+tax rate)* (1-discount rate)=USD300*(1+0.2)*(1-0.5)=USD180

2 Logistics costs: freight* (1+tax rate) = USD10* (1+0.2) = USD12.00

3 Estimated value-added tax [platform tax]: (total product amount - store discount) * tax rate / (1+ tax rate) + logistics cost * tax rate / (1 + tax rate) = (180-30) * 0.2/1.2 + 12 * 0.2/1.2 = USD27 "platform tax is taxed" that is, the platform according to relevant regulations If the buyer is not charged VAT, the relevant VAT tax liability is still with the seller/buyer.

4 Store discount: full discount - USD10, coupon - USD10, discount code-USD10, total USD30 (according to the order of discount deduction, meet the sum of the store discount threshold, various discount deduction order: single product discount > cross-store full discount > oil plan (i.e. cross-store full) Free shipping) > full free shipping > full discount > store coupon > store discount code)

5 Order amount: product amount + logistics cost - store discount - estimated value-added tax = USD180 + 12-30-27 = USD 135

Tax-excluding logistics fee portion of order amount: logistics fee / (1+ tax rate) = USD10

Tax-exclusive goods part of order amount: order amount - tax-excluding logistics fee part of order amount = USD135-10=USD125

6 Transaction commission: tax-free commodity part of order amount * commodity commission rate + tax-free logistics fee part of order amount * logistics commission rate = USD 125*8% + 10*5% = USD10.5

7 Alliance commission: tax-excluding goods of the order amount * Alliance commission rate = USD 125*10% = USD12.5

8 Expected availability: Order amount - transaction commission - alliance commission = USD 135-10.5-12.5 = USD 112

9 Buyer's payable: total product amount + logistics cost - expected value-added tax (platform tax) - store discount - platform / payment channel discount (if any), the platform / payment channel discount merchant cannot know, so when the merchant finds that the buyer's pays to match the order amount, it is generally due to the use of platform/payment channel. Offer.

[Tax price included] Refund

Q: How to calculate the refund amount for tax-inclusive orders?

Answer: The refund amount includes tax, and merchant refund, tax refund and commission refund are calculated proportionally.

For example: For order A, the consumer payment amount is USD 100, of which merchants can get USD 80, taxes are USD 15, and the platform commission is USD 5.

1 When consumers apply for a full refund, the refund is USD 100, the merchant refunds USD 80, and the tax USD15 and the platform commission USD5 are refunded together;

2 When consumers apply for a partial refund, the refund is USD 80, the merchant refunds USD 64, and the tax USD12 and the platform commission USD4 are refunded together.

5. [Tax price included] Logistics

Q: What is the impact of tax-inclusive prices on logistics network regulations?

Answer: The amount of network regulations will be increased in proportion according to different tax rates in different countries.

For example: Before the tax price is launched, the original $4 free shipping goods sent to Spain can use simple lines within the network regulation amount of $5. After the tax price is launched, if the tax rate is 25%, the tax price will be $5, and the amount of the network regulation will also rise to $6.25 accordingly. Within the amount of the network regulation, it can still Use simple lines.

Comments

Post a Comment